Types of retirement accounts worksheet – Retirement planning is a crucial aspect of financial well-being, and understanding the various types of retirement accounts available is essential. Our comprehensive worksheet provides a detailed overview of 401(k), 403(b), IRA, Roth IRA, and SEP IRA, empowering you to make informed decisions about your retirement savings strategy.

Types of Retirement Accounts

Retirement accounts offer tax-advantaged ways to save for the future. The different types of retirement accounts available vary in terms of contribution limits, eligibility requirements, and tax treatment. Understanding the key features of each account type is crucial for making informed decisions about retirement planning.

401(k) Plans, Types of retirement accounts worksheet

- Employer-sponsored retirement plans

- Contributions deducted from employee’s paycheck on a pre-tax basis

- Employer may offer matching contributions

- Contribution limits for 2023: $22,500 ($30,000 for individuals aged 50 and older)

403(b) Plans

- Retirement plans for employees of public schools and certain non-profit organizations

- Similar to 401(k) plans in terms of contribution limits and tax treatment

- Contribution limits for 2023: $22,500 ($30,000 for individuals aged 50 and older)

Individual Retirement Accounts (IRAs)

- Retirement savings accounts available to individuals

- Two main types: Traditional IRAs and Roth IRAs

- Contribution limits for 2023: $6,500 ($7,500 for individuals aged 50 and older)

Roth IRAs

- Contributions made on an after-tax basis

- Earnings grow tax-free

- Withdrawals in retirement are tax-free

- Income limits apply for eligibility

SEP IRAs

- Simplified Employee Pension plans

- Designed for self-employed individuals and small business owners

- Contributions made by the employer on behalf of the employee

- Contribution limits for 2023: 25% of employee’s net income up to $66,000

Choosing the Right Retirement Account

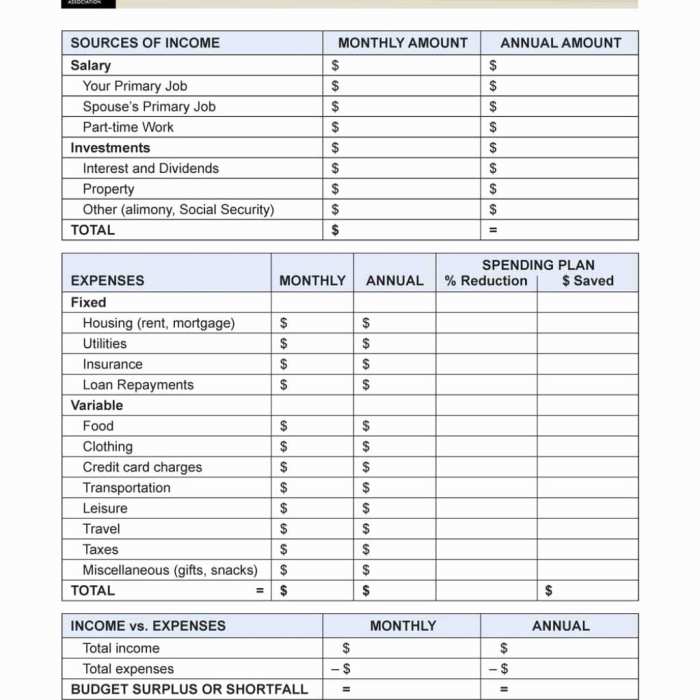

The best retirement account for you depends on your individual circumstances and financial goals. Factors to consider include:

- Age

- Income

- Risk tolerance

- Investment goals

If you are young and have a high risk tolerance, a Roth IRA or 401(k) plan may be a good option. If you are closer to retirement and have a lower risk tolerance, a traditional IRA or SEP IRA may be more suitable.

Maximizing Retirement Savings

To maximize your retirement savings, it is important to:

- Contribute the maximum amount allowed to your retirement accounts each year

- Reduce expenses and increase income to save more for retirement

Even small contributions made consistently over time can grow significantly through the power of compound interest.

Managing Retirement Accounts: Types Of Retirement Accounts Worksheet

Once you have opened a retirement account, it is important to manage it wisely. This includes:

- Investing wisely

- Tracking performance

- Rebalancing portfolios

Diversification and asset allocation are key principles to consider when managing retirement accounts. Avoiding common mistakes, such as panic selling or investing too conservatively, is also essential for long-term success.

Helpful Answers

What is the difference between a traditional IRA and a Roth IRA?

Traditional IRAs offer tax-deferred growth, while Roth IRAs provide tax-free withdrawals in retirement. Contributions to traditional IRAs are tax-deductible, while Roth IRA contributions are made with after-tax dollars.

What is the maximum contribution limit for a 401(k) in 2023?

The maximum contribution limit for a 401(k) in 2023 is $22,500, with an additional catch-up contribution of $7,500 for individuals aged 50 and older.

Can I withdraw funds from my retirement account before retirement?

Early withdrawals from retirement accounts are generally subject to taxes and penalties. However, there are certain exceptions, such as withdrawals for qualified medical expenses or higher education costs.